Feb 11, 2026

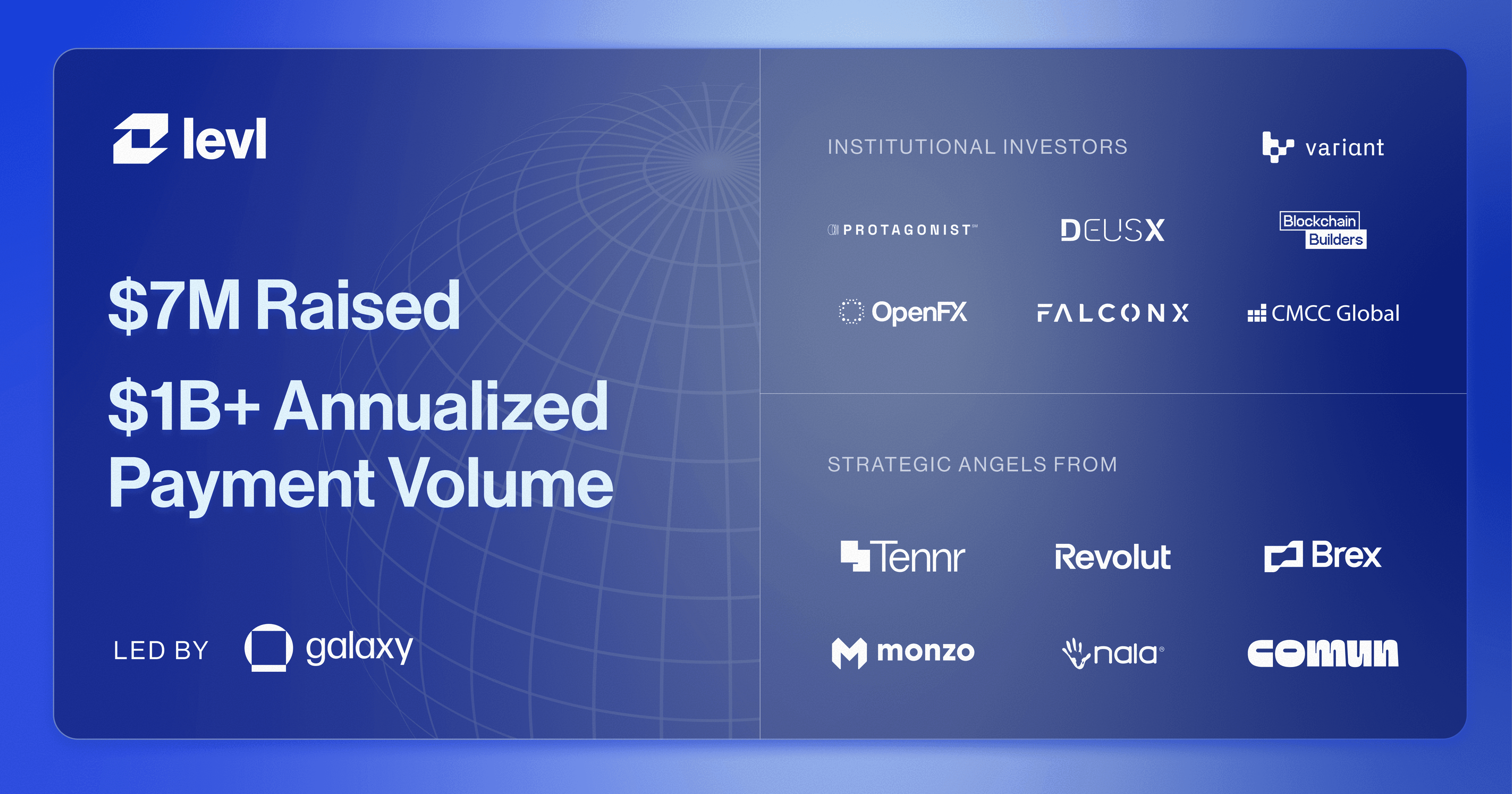

We're building momentum. Today, we announced the closing of a $7 million seed funding round led by Galaxy Ventures with participation from Protagonist, Deus X, Blockchain Builders Fund, OpenFX, FalconX, CMCC, Variant Fund, and a strategic angel network including leaders from Revolut, Brex, Comun and many other leading fintechs.

This investment arrives at a defining moment for our platform. Within just four months of operation, Levl has already reached $1 billion in annualized payments volume. We're proving that businesses want faster, more accessible infrastructure for moving money across borders, and we're delivering it at scale.

Redefining Global Payments Infrastructure

The global cross-border payments market is projected to reach $320 trillion by 2032, yet it remains constrained by legacy financial systems that create slow settlements, fragmented money movement, and inflated FX costs. The infrastructure hasn't kept pace with how businesses operate today.

At Levl, our mission is to democratize access to modern financial infrastructure by bridging traditional payment systems with new digital rails. We handle the technical complexity of blockchain infrastructure behind the scenes, allowing businesses to process payments and move money instantly across major markets without building in-house solutions or navigating the fragmentation of legacy systems.

Fast, Cost-Effective, Compliant

Our unified platform powers fiat and stablecoin (USDC, USDT) global payments, making them accessible, compliant, and operationally seamless for traditional businesses. Same-day settlement replaces the 3-5 day delays typical of traditional correspondent banking with near real-time processing. We support payouts in 75+ countries, with deep connectivity across emerging markets in Asia, Latin America, and Africa. Our platform unlocks the cost advantages of blockchain technology, beating the interbank rate and delivering meaningful savings to our clients.

We're proud to be trusted by institutional leaders including TerraPay, Nala and RemitBee. Currently, Levl serves more than 1 million end-users via our network of clients, which includes mobile wallets, neobanks, fintechs, and remittance platforms.

"Global businesses see the potential of stablecoins to make payments faster and cheaper, but they need solutions that are compliant and easy to use—ones that fit into how they already operate," says Jaisel Sandhu, CEO of Levl.

What's Next

With this new capital, we will expand our product offerings to include broader B2B cross-border coverage, card and stablecoin payment processing, and lending solutions. Regulated in Switzerland and Canada, we remain committed to providing fast, secure, and seamless global payments.

The future of cross-border payments is being built today. We're excited to be leading it.

Fortune's Exclusive - https://fortune.com/2026/02/11/levl-raises-7-million-to-provide-stablecoin-infrastructure-for-fintechs/?for40f

Business Wire - https://www.businesswire.com/news/home/20260211668795/en/Levl-Raises-%247-Million-Seed-Round-to-Bridge-Traditional-Banking-and-Stablecoin-Payments